Visit to South-Korea

The CEO of E-residency Hub, Mr. Martin Lään visited the Estonian embassy in Seoul, South-Korea. In a meeting with Estonian ambasador, H.E. Mr. Sten Schwede, a plan was agreed to hold a webinar for South-Korean entrepreneurs, introducing the Estonian e-Residency programme.

Ambasador Schwede highlighted the entrepreneurial spirit of Koreans and the high level of technological innovation of the country. Combined with Estonian fully digital business ecosystem it makes an attractive value propositions for service exporters to the EU in particular.

E-residency Hub is looking forward to speaking at the webinar, which is currently scheduled for 2nd half of 2025.

Last week, we at E-residency Hub were delighted to welcome a delegation of vocational students from Spain! The students of IT and management were on a study visit, organised by one of Estonian e-Residency’s community leaders, Ms. Laura Roman.

Our CEO, Mr Lään introduced the company and also his personal story as an entrepreneur. In comments after the visit, Mr. Lään said it was extremely refreshing to talk to young people who are in the process of making career plans and have so may opportunities open to them.

We wish the students the best in making their dreams come true and hope that Estonian e-Residency can be a useful tool for many of them in that process.

You can read about Ms. Roman’s story in a dedicated blog post here.

Value Added Tax (VAT) is a tax that is commonly used in the EU and in many other countries in the world. Various aspects of the tax are discussed in our FAQ section and in a dedicated memo we have compiled on the subject.

In certain cases, it is possible for your Estonian company to register for VAT in Estonia and get an Estonian VAT number. For our clients, this process is handled by your accountant at E-residency Hub.

It is important to remember that:

it is possible and entirely normal to operate a company in Estonia without registering for VAT and without getting a VAT number. In fact, about 2/3 of companies registered in Estonia do not have a VAT number

VAT registration in Estonia should only be done if certain criteria are met.

Before you decide to apply for an Estonian VAT number, you should think about whether or not your company really needs the VAT number. If you are sure that it is needed, make sure that your company corresponds to at least some of the following criteria:

- You sell your goods or services to private individuals in the EU

- You have a physical office in Estonia

- You have employees, who receive regular salary from your company and who live in Estonia

- You have suppliers in Estonia – companies from which you regularly buy goods or services

- You have clients in Estonia who regularly buy your goods or services

- You sell or buy physical goods which are warehoused in Estonia and are then shipped to clients from Estonia

- You already pay or intend to pay other taxes in Estonia (e.g. corporate income tax, taxes of fringe benefits, Board Member Fees, etc)

In case your company does not meet any of the criteria above, we strongly advise you to NOT apply for a VAT number in Estonia. If you still do that and apply for a VAT number, then even if the VAT number is given to your company, the Estonian Tax and Customs Board has the right to take the number away from your company in case they establish that the requested criteria are not met.

In case most or all your business is done in a country outside Estonia, you may also consider applying for a VAT number in that country. In such cases, please remember that E-Residency Hub does not offer VAT reporting services in countries outside Estonia.

For registering your Estonian company for VAT in other countries around the world, we recommend that you get in touch with https://www.taxually.com/

Every business needs a bank account. Many E-residency Hub clients have chosen to use Revolut Business for their corporate bank account and payment card. An account with Revolut Business enables you to receive and make international payments, transferring money to 150+ international destinations. You can also get a physical or virtual debit card with which you can make payments for any goods or services your business may need.

Once your Estonian company has been set up, you can start the process by clicking here.

Revolut Business accounts are available for Estonian companies in case at least one of their Board Members of Shareholders is a citizen or a resident of a country in this list

For a complete list of Revolut services, please refer to Revolut’s home page.

On March 19-20, E-residency Hub team participated in the Transform trade-fair in Berlin, at the invitation of the Estonian government’s e-Residency Team.

During the two days of the event, we introduced Estonian e-Residency to hundreds of German start-up founders and entrepreneurs. It was truly a pleasure to find that so many people already knew about the e-Residency programme before coming to talk to us at the e-Residency booth!

The two days saw many discussions about the benefits of borderless, 100% online, fast and transparent infrastructure that the Estonian e-Governance system offers. On a few occasions some of our existing clients also dropped by. It was really cool to meet them in person, as mostly all interactions are done online!

We are proud to be part of the Estonian e-Residency ecosystem and are always happy to contribute to spreading the word.

E-Residency Hub welcomed a group of Kenyan businessmen on their fact-finding mission to Estonia.

On February 17 our CEO, Mr. Lään introduced the services and benefits of e-Residency and an Estonian company to the entire delegation of 30 people. The following day, discussions continued in a smaller group.

E-Residency Hub wishes to thank Enterprise Estonia, and the Estonian honorary consul in Nairobi (Mrs. Kadri Humal) for arranging the visit. We look forward to many fruitful business relationships to arise from this undertaking.

At E-residency Hub we use a package-based pricing model. This means that once you have chosen a service package, you know exactly what your monthly payment will be for accounting services. We believe this is a more transparent approach than an hour-based billing system often used by consultancies and law firms where the final cost for the client remains unclear until the service provider counts the time they have spent.

At the same time – our packages have a clearly defined scope of services they include. You can see the details on our pricing page.

Running a business is always full of uncertainties and unexpected developments. We understand that and can support our clients also when their volumes grow, and they need more services than their current package may contain. In such cases the client has the option of an upgrade to a different (larger or smaller) package or a one-off extra charge for any irregular work that may be needed.

It is very important for the client to understand what is included in our service packages, what are the things we can offer as extra services for an extra fee and what are the things that we cannot offer to our clients. In the latter case, we always try to point clients to a partner or another service provider that may be able to help out.

So, here goes…

What we do

- Booking the bank statements – once per month we download your company’s bank statements from the company’s bank or fintech service (Wise, Revolut, etc) and process them in our accounting software.

- Booking transactions – once per month we take all the invoices, receipts, travel and expense reports that the company has created and uploaded to Envoice and we process them in our accounting software.

The Client is obliged to create sales invoices, using our Envoice system. Alternatively, the client can provide us with their monthly sales data in a separate file using a formatting determined by E-Residency Hub.

- Remind you about missing documents – if we see from your company’s bank statement, that you have made or received payments that you haven’t provided us documents about, we will remind you to upload these documents and give you a deadline to upload them.

With these missing documents, you as a business owner, will have three options:

-

-

- Option #1 – find the missing documents and upload them to Envoice

- Option #2 – compensate the undocumented expenses to your company

- Option #3 – pay 25% of corporate income tax in Estonia

-

Example

You have used the company bank card to buy something for 100 €. You have not submitted to us an invoice or a receipt about the purchase and you chose not to compensate the expense to the company.

We shall declare this 100 € as an “undocumented expense” and on the 10th day of the following month your company needs to pay 25 € of corporate income tax in Estonia.

After paying the tax, you are no longer obliged to include the receipt in your company’s accounts and the case shall be closed

- Prepare the Annual Report – once per year, we will prepare your company’s Annual Report and present it to the Management Board members for signing. Each year, you are required to write a few paragraphs of text, summarising the company’s activities during the year as well as describe your plans for the future. This summary can be rather brief (half a page, not more).

Attn! This summary as well as the entire Annual Report is publicly available to anybody through the portal of the Estonian Business Registry!

- Monthly balance sheet and P&L statement (upon request) – if you wish, we will prepare once a month a balance sheet as well as a profit and loss statement (P&L) covering a period of your choice.

What we can do for an extra charge

We try to be flexible and offer our clients all the support they need in running and growing their business. Therefore – if you need things that are not included in the package that you currently have, please get in touch with us. We may be able to find a solution that suits you. Such special cases may include the following:

- Processing any financial documents that are submitted late (i.e. after the 5th day of the following month)

- Altering previously submitted VAT declarations in case new data becomes available after the reports have already been submitted to the Estonian authorities.

- Sending additional reminders for the client to submit their financial documents (the first reminder about missing documents is free of charge. All additional reminders carry a 25 € + VAT extra charge)

- Booking more invoices / receipts than your package contains

- Booking more bank accounts and/or currencies than your package contains

- Tax advice regarding Estonian rules and regulations

- Preparing statistical reports in case the Estonian Statistics Board requires these from your company

- Hold video calls during which we can give you updates about your company’s financial situation.

Here is a list of the most common procedures and their respective fees. If what you need is not listed there, feel free to get in touch and request a quote.

What we can NOT do for you

- Tax advice regarding countries other than Estonia.

- Legal analysis and advice regarding Permanent Establishment.

- Legal advice – reviewing contracts, drafting by-laws, etc (we can refer you to law-firms that we partner with).

- Issue utility bills or other documents that would falsely demonstrate your company’s physical presence in Estonia.

- Use other accounting software than Envoice and ErplyBooks to keep your company’s books.

- Give you direct access to our accounting software (ErplyBooks).

- Consultations about business development or investments.

- Monitoring payment statuses. It is the client’s responsibility to make sure their bills are paid for the goods and services they buy and also to monitor if and when they receive payments from their clients.

- Real-time accounting – we update the company’s accounts once per month. We cannot determine the exact moment in time when a concrete client’s accounts will be updated. This is subject to the workflows that the accountant has. Therefore, we cannot guarantee that all financial data is always available upon request. All transactions are booked monthly though and by the end of a calendar month, the previous month’s transactions will have been booked.

As you know, your e-Resident’s ID card is required to identify yourself in Estonian government databases and registries and for signing documents. In other words, it is crucial for running your Estonian company.

Did you know there was also an easier way to do these same things? Smart-ID enables you to do the same things, without needing to carry with you the ID card and the reader device. It is FREE of charge for you, so it is highly recommended to download the app and use it in parallel or instread of your e-Resident’s ID card. The functionalities are the same and you can do all the things your Estonian company needs.

It may also prove useful in case your e-Residency card expires and you need to identify yourself or sign some documents before the new card is issued to you. Please make sure to activate your Smart-ID before your e-Residency card expires, because during the activation phase you will need to use your original e-Residency card once.

You can solve all these problems by using Smart-ID. It is a secure digital solution available through an app on your smartphone.

Read more and subscribe here: https://www.smart-id.com/

e-Residency Hub together with the Estonian government’s e-Residency team organised two masterclasses in Greece on November 7 and 8, 2023.

The two events took place in the cities of Athens and Thessaloniki. At the masterclasses we introduced the possibilities that Estonian e-Residency offers to entrepreneurs interested in an online, efficient and paperless business environment. Issues of taxation, focussing on the Greek market were also discussed, helping participants understand the various tax implications that arise from conducting international business operations, using an Estonian company.

Both evenings created a lively discussion with the audience and participants showed a keen interest in becoming e-Residents. Many existing e-Residents also took part and shared their experiences gained during many years of successful management of an Estonian company using their e-Residency.

Our managing director Martin Lään commented on his experience of speaking at both masterclasses: “It was such a thrill to introduce our work, our value offering and our clients’ stories to such an experienced and keen audience. I very much hope that the participants of the two masterclasses will soon join the ranks of the 1,000 e-Residents from Greece that already use the Estonian business architecture and we will see an addition to the 400 companies that Greek e-Residents already own and manage in Estonia”.

The masterclasses in Greece were organised and sponsored by the Estonian Government’s e-Residency Team and the Estonian embassy in Athens. We thank these organisations for their initiative and for the opportunity to be part of the ever-growing world of e-Residency.

With a Wise multi-currency account you can send, spend and receive money in over 50 currencies. Your money will always be converted at the real exchange rate helping you avoid hidden fees from exchange rate mark ups. International payments are up to 14x cheaper than PayPal and you can receive payments in USD, EUR, GBP, NZD, AUD and SGD for free with your own local account details. Used by over 8 million customers worldwide, Wise are on a mission to make moving money around the world as cheap, transparent, convenient and fair as possible.

e-Residency Hub is happy to announce a partnership with Wise. To open your account, please click here

Opening a Wise account for your Estonian company costs €19 (a one-time fee)

Founded by the first employee of Skype and used by over 8 million customers; the Wise multi-currency account gives you access to unique bank account details for the UK, Eurozone, US, Australia, New Zealand and Singapore (with new currencies being added all the time). There’s no set up fee or monthly costs – the only fee you’ll pay is a small, upfront cost on the value of your transfer which is up to 14x cheaper than PayPal for international payments. With an account you can:

- Hold 50+ different currencies within the one account and convert between them at the mid-market exchange rate.

- Only costs are a small, upfront fee on the value of transfer

- Pay invoices, buy inventory and handle payroll with the real exchange rate in over 70 countries

- Receive international payments from the US, Eurozone, UK, Australia, New Zealand and Singapore with no fees using your own local account details

- Business debit card available so you can spend anywhere at the mid-market exchange rate

- Manage your payments online and on mobile

- Global customer support via phone, email and chat

- Made for business owners doing business across borders

For a step-by-step instruction about how to open your account, click here.

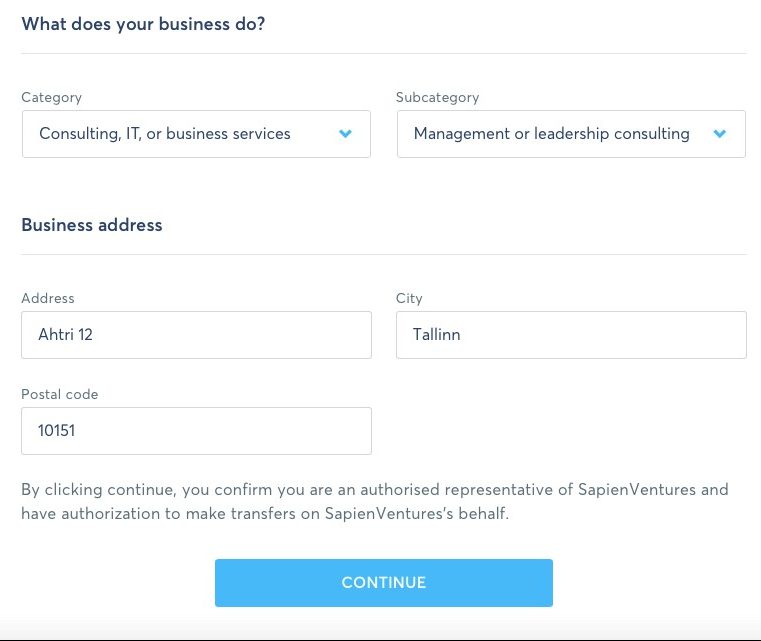

Once your Estonian company has been established, here is a step-by-step guide to opening an account with Wise. Please note that opening a Wise account for your Estonian company costs €50 (a one-time fee):

- After the registration of your company has been confirmed by e-Residency Hub, click here to start your Wise account registration process.

- If you already have a personal Wise account then log-in and click on the top-right menu where you see your name. Here you will find an option to Create a business profile, please click this option instead to proceed

- Choose Business and sign-up

- You will immediately receive an e-mail to confirm your e-mail address. Please complete this verification to continue

- Please fill the relevant details (as shown). Note: You will need to enter the registration code of your Estonian company which can be found in the confirmation e-mail received from the e-business register. In the business address, please enter the information as shown

- After completing Step 4, you will be asked to fill your personal details. Note: Please enter all details as they are mentioned in your national passport document. Please enter a mobile phone number which you use on a regular basis, especially for your business activities. Under the Phone section, there is an option to verify your new mobile phone number and it is recommended that you verify it even though this is optional. In the Your Address section, please enter the actual address where you live

- After completing Step 5, you will need to choose the reason for opening a TransferWise Business Account, please choose a relevant option and click Continue

- You will now need to upload a scanned copy of your passport. Even though you have the option to upload a copy of a different national ID document, we highly recommend that you upload a copy of your passport. Note: You can only upload a .JPG or .PNG file. If you have a .PDF or .DOC file then you can go to https://smallpdf.com and convert the file to .JPG for free. Please note, e-Residency Hub only recommends this solutions and does not take any responsibility as to the privacy…, etc. Please ensure that the quality of the document you upload is high-quality and readable

- After completing Step 7, you will need to confirm if you are the sole owner or have other stakeholders. Please choose the relevant option

- Following this step, you will be asked to again verify your personal information and then asked if you are the sole director of the company or have other directors. Please choose the relevant option

- Upon completing this step, you will receive a confirmation (as shown) and will then have to wait for 3-5 working days for the information provided to be verified. You will receive an e-mail once the verification has been completed and your account is ready for use. Note: You might be asked to provide additional documents, etc. by the TransferWise team. If asked, please provide them the relevant documents, including a utility bill of where you operate from with all the relevant details regarding the address, etc. of the exact address you operate from (this address should also be reflected on the business registry document you receive from e-Residency Hub since the registered business address would be the virtual office address in Estonia but the operating address would be the address you supplied of where you operate from). In some cases for example, this could even be your residential electricity bill if you do not have a separate physical office

In addition to the services offered to our clients as part of their service package, e-Residency Hub offers a wide variety of other services that your business may need. A list of such services, together with the respective fees, is given below.

All fees are quoted without the Estonian VAT of 24%.

| Service | Price without VAT |

| Services related to company documents | |

| Certificate of income tax paid on dividends | 25 € |

| Notarised company registry card (in English or Estonian) | 20 € |

| Notarised company Articles of Association (in Estonian) | 20 € |

| Notarised Articles of Association (sworn translation to English) | 100 € |

| Notarised Articles of Association (sworn translation to other languages) | Depends on language |

| Company Certificate of Tax Residency | 20 € |

| Notarised list of Beneficial Owners (in English or Estonian) | 20 € |

| Apostille | 45 € |

| Courier and mailing services | |

| Forwarding documents to client (UPS courier) | 90 € |

| Forwarding documents to client (registered mail) | 30 € |

| Dissolving / liquidating a company | |

| Dissolving a company | 400 € |

| Service fee for taking back a liquidation petition | 50 € |

| Changes in the Commercial Register | |

| Making changes in the Estonian Business Registry, that do not require a decision of the shareholders (e.g. changing contact data or paying in share capital). Includes state fee of 25 € | 75 € |

| Making changes in the Estonian Business registry, that require a decision of the shareholders (e.g. changing board members, increasing share capital or making changes to the company Articles of Association. Includes state fee of 25 € | 125 € |

| State fee for reinstating a company in case the company was deleted bt the Registry keeper (no VAT is added) | 200 € |

| Processing the company reinstateement | 50 € |

| Accounting services (in case volumes exceed the limits of the service package) | |

| Extra bank account / payment gateway

Investment account or crypto wallet |

25 € / month

35 € / month |

| Additional sales channel or Amazon marketplace | 45 € / month |

| Extra invoices (price for each batch of 25 invoices) | 25 € |

| Additional currency | 25 € / month |

| Processing a refund of VAT paid in other EU countries | 50 € / h |

| Applying for an EORI number | 30 € |

| Making amendments to previous VAT declarations (in cases documents are submitted late by the client) | 50 € / declaration |

| Video consultations | |

| Consulting services via video call about e-Residency and operating a company in Estonia (minimum time 30 min) | 50 € / h |

| Services requiring a notary | |

| Preparing Power of Attorney documents for the notary and representing client at the notary (fee includes notary fees). In case of more than 3 parties to the transaction, fee shall be higher | 400 – 1,000 €

(exact quote depends on the structure of the deal) |

In cooperation with the Estonian government’s e-Residency Team we introduced e-Residency and our services to the German start-up community.

The event had about 5000 participants from Germany and beyond. Interest in the Estonian e-Residency was lively. We also had the chance to introduce Estonian e-Residency and our start-up unicorns on the main stage of the event. A side-session took place, where international taxation issues surrounding e-Residency were discussed in more detail.

In the evening before the conference, there was a separate event for existing and future e-Residents. Our manager, Mr Martin Lään spoke at the event as a panellist, introducing the services e-Residency Hub can offer to e-Residents, starting the corporate journey.

Thank you all who participated in these events and see you next time!

e-Residency Hub launched a cooperation with KPMG, to support Estonian e-Residents in operating their businesses and providing more knowledge about taxation and accounting.

The first article is about the One-Stop-Shop (OSS) scheme for online sellers for paying their VAT. In the article we look at the impact of the new scheme from the viewpoint of companies registered in Estonia that sell goods in their online stores that are stored in a warehouse located in another Member State or that are located outside of the EU and transported into EU once the consumer has placed an order.

Today, Estonia’s largest daily business newspaper “Äripäev” recognised e-Residency Hub as the second fastest growing accounting firm in the country.

Upon receiving this recognition, we would like to thank all our clients for your continued trust and cooperation. Our growing team works hard every day to provide our clients with the high-quality support they need to make it in today’s fast-changing global business environment.

e-Residency Hub and Tehnopol Start-up Incubator offer: enrol in the Start-up Incubator of Tehnopol and get 6 months free accounting and contact point services.

Tehnopol is the largest science park in the Baltics. e-Residency Hub in cooperation with Tehnopol Start-up Incubator, offer 6 months of free accounting services to e-Residents who set up their companies via e-Residency Hub and get admitted to the incubator.

At the Tehnopol Start-up Incubator you get

- Fully online participation in the incubator

- 6 practical and exclusive training days from the experts of Tehnopol

- Thousands of euros worth of expert advice from mentors from Estonia and rest of Europe

- 6-months free accounting service s from e-Residency Hub

- An equity option agreement, no monthly fee

- A united community and wide network of contacts

Terms of campaign

- Free accounting services are offered, based on the service description of e-Residency Hub’s standard package

- Offer is valid for companies who get admitted to the Tehnopol Start-up Incubator not later than on 31.12.2021

Further integration between e-Residency Hub and Wise improves user experience

e-Residency Hub is happy to announce a new integration with Wise. From now on, our clients’ Wise accounts can be linked with our accounting platform Envoice.

Now our clients can:

- See the balance of their Wise account on the Envoice dashboard in real time,

- See the Wise account statement in the Envoice platform,

- Purchase invoices which have been paid to the company’s Wise account are automatically marked as “paid”,

- Sales invoices which have been paid by your clients to your Wise account, are automatically marked as “paid”.

We hope that this new improvement further reduces the amount of effort from our clients and allows them to further concentrate on the fundamentals of building their businesses.

Wise and e-Residency Hub celebrate our first full year of partnership in providing our clients with smooth and simple payment solutions. The newly operational API is a further step in the long term goal of continuously developing our services together.

In case you do not yet have a Wise account, you can find instructions about it on our website.

For detailed instructions about how to set up the API, click here or contact your accountant at e-Residency Hub.

Accounting processes for online sellers of digital services and software subscriptions can vary, depending on the exact nature of their business model and processes these sellers have in place. For such businesses, we offer our services, based on a “base fee + additional services” model.

Base fee

The Base Fee of €175 per month covers the following accounting services.

- Booking up to 1,500 sales invoices monthly

- 2 Bank accounts / Payment Service Provider accounts

- 1 sales channel (in case your various sales channels are all linked to one software (e.g. Quaderno or Paddle), they shall be considered one sales channel

- Mini One-Stop-Shop (MOSS) declaration once per quarter

In case you do not give us access directly to your sales software (such as your Shopify account), you need to provide us your sales data each month:

- Detailed sales data in this format.

- Detailed payment data. All payments must be clearly connected to concrete sales transactions.

Additional services and fees

Additional fees are charged only in the case they specifically apply to your business model. The additional fee rates shall be fixed in our contract with your company. In case your business grows or your business model changes, please let us know, so we could adjust the additional fees if needed.

Additional fees for SaaS business models are given in the table below

Additional accounting fees for SaaS businesses

| Service | Details | Additional charge per month |

| Additional sales channels | A “channel” can be an e-commerce platform such your own website(s) or Shopify or any other additional tool you use to sell your services.

Extra charge applies if you sell your services in different channels. In case your services in various sales channels are all linked to one software (e.g. Quaderno or Paddle), they shall be considered one sales channel. |

€45 per each additional sales channel |

| Processing more than 1,500 sales invoices per month | You can give e-Residency Hub access to your sales platform, in order for us to extract your sales data. | €25 in case your company has in total 1,501-2,000 transactions per month

Additional €25 for each additional 500 transactions (starting from the 1st transaction that exceeds the limit).

|

| More than 25 purchase invoices per month | In addition to invoices we also accept receipts (e.g. hard copy paper slips, issued by the seller’s or service provider’s cash register). | €25 in case your company has in total 26-50 purchase invoices per month

Additional €25 for each additional 25 invoices (starting from the 1st invoice that exceeds the limit)

|

| More than 2 bank accounts (or payment service provider accounts) | €25 for each additional account | |

Example

A company sells subscriptions to their services on 2 different websites. These websites are not linked to Quaderno or Paddle.

- They have 1,530 sales transactions and invoices per month

- They have 30 purchase invoices

- 3 accounts: Wise (€), Wise (USD) and PayPal (€)

The monthly accounting costs for such a company would be the following

| Base fee for SaaS companies | €175 |

| +1 extra sales channel | €45 |

| 1,501-2,000 sales transactions | €25 |

| 26-50 purchase invoices | €25 |

| +1 additional bank account | €25 |

| Total monthly cost for services | €295 |

| Estonian VAT of 24% | €70.80 |

| Grand total | €365.80 |

Accounting processes for online sellers of physical goods can vary, depending on the exact nature of their business model and processes these sellers have in place. For such businesses, we offer our services, based on a “base fee + additional services” model.

Base fee

NB! Please note that Estonian VAT of 24% will be added to all fees quoted below.

The Base Fee of €175 per month covers the following accounting services.

- Booking up to 25 monthly purchase invoices/receipts

- Booking up to 1,500 sales invoices

- One Amazon marketplace or other sales channel

- Up to 2 bank accounts OR payment gateways (e.g. TransferWise + Stripe

Additional services and fees

Additional fees are charged only in case they specifically apply to your business model. The additional fee rates shall be fixed in our contract with your company. In case your business grows or your business model changes, please let us know, so we can adjust the additional fees if needed.

Additional fees for e-commerce companies (i.e. companies selling physical goods online, using various e-commerce portals such as amazon.com, Shopify, Etsy, etc) are given in the table below

Table #1 – additional accounting fees for e-commerce businesses

| Service | Details | Additional charge per month |

| Additional Amazon marketplaces

|

As your business grows, you may wish to start selling your goods on more than one marketplace. Amazon provides data separately about each marketplace and also our accounting services separate the different marketplaces

Extra charge applies in case you use several Amazon marketplaces (such as amazon.de, amazon.co.uk, amazon.it, etc). |

€45 per each additional marketplace |

| Additional sales channels | A “channel” can be an e-commerce platform such as Shopify or your own website or any other additional tool you use to sell your product

Extra charge applies if you sell your products in different channels. |

€45 per each additional sales channel |

| More than 25 purchase invoices per month | In addition to invoices we also accept receipts (e.g. hard copy paper slips, issued by the seller’s or service provider’s cash register). | €25 In case your company has in total 26-50 purchase invoices per month

Additional €25 for each additional 25 invoices (starting from the 1st invoice that exceeds the limit) Note for dropshippers: in case you are buying your goods from one or few sellers, and these sellers can issue a combined invoice for all your purchases of a month, such invoice shall be considered as one invoice, regardless of how many items are listed on the invoice. |

| More than 1,500 sales transactions per month | In case of Amazon, you need to give us access to your Amazon Seller’s account, so we can extract all the relevant data.

In case you do not give us access directly to your sales software (such as your Amazon or Shopify account), you need to provide us your sales data using this template. |

€25 In case your company has in total 1,501-2,000 transactions per month

Additional €25 for each additional 500 transactions (starting from the 1st transaction that exceeds the limit) |

| More than 2 bank accounts (or payment service provider accounts)

|

€25 for each additional account

|

|

Inventory

Keeping exact inventory of your goods can be an important element of managing an e-commerce business. You may need detailed information about how many items of each Stock Keeping Unit (SKU) you currently have available, in which (Amazon) warehouse these units are located and what is their value.

Amazon itself does not provide such information for you in sufficient detail. Many e-commerce businesses therefore use additional software applications that can be linked up with their e-commerce sites, such as Amazon, Shopify, Etsy and/or their own various web-shops. This way an integrated and wholesome information can be obtained that will support the strategic planning of your business.

E-Residency Hub does not provide inventory keeping services. We recommend the following applications, which our clients often use. These applications provide information about your company’s inventory:

We recommend that you check out the possibilities of these platforms. As your accounting service provider, we only need input from you about the year-end value of your inventory. In case you require us to include your inventory value in your company’s balance sheet on a given day or a profit & loss statement for a given period, you must give us the inventory value at these specific dates.

Example

A company sells their products on amazon.de and amazon.com marketplaces

- They have 1,530 sales transactions and invoices per month

- They have 30 purchase invoices

- 7 different fees that they pay to Amazon for promotions, handling, packaging, etc

- 23 purchase invoices from producers of the product

- 3 accounts: Wise (€), Wise (USD) and PayPal (€)

The monthly accounting costs for such a company would be the following

| Base fee for e-commerce | €175 |

| +1 extra Amazon marketplace | €45 |

| 1,501-2,000 sales transactions | €25 |

| 26-50 purchase invoices | €25 |

| +1 additional bank account | €25 |

| Total monthly cost for services | €295 |

| Estonian VAT of 24% | €70.80 |

| Grand total | €365.80 |

Holvi has announced that their corporate bank cards are working again. Read the statement here:

Original post below

Holvi has issued a statement, announcing that their MasterCards are curently suspended because of recent events in connection with the insolvency of Wirecard AG. The statement can be read here.

For our clients who face problems regarding this issue, e-Residency Hub recommends to apply for a TransferWise account and bank card. TransferWise cards are working properly and can be used for all business transactions. For detailed information about how to open a TransferWise account, please see our instructions here.

Please note that in case you live in one of these countries, your TransferWise card can be delivered directly to your home country. For clients living in other countries of the world, your TransferWise card can be delivered to e-Residency Hub in Estonia. We will then forward your card to you.

Becoming an e-Resident and establishing a company in Estonia is a modern and efficient way to conduct your business. Estonia’s world leading e-governance infrastucture makes the administration of your company easy and you will be able to conduct the entire process online, wherever you are physically located. Also – Estonia’s corporate income tax system offers advantages to companies interested in re-investing their earnings into growing their business.

At the same time, the option of running your business using Estonian e-Residency programme and a Private Limited Company established in Estonia is not a one-size-fits-all solution for all types of business models. We hope some of the following guidelines can be helpful to you in making the decision about in which country to incoporate your business.

“e-Residency + company in Estonia” solution works very well for

- Digital nomads / Freelancers – one-man operations or small groups of business partners, who mainly just need their laptop to work and often travel around in different locations.

- IT service providers – Businesses where services are entirely taking place online (programmers, software developers, IT startups, etc).

- Consultants – Businesses and individuals who are selling their skills in a concrete professional field (business, finance, law, health, etc).

- Creative services – Architects, designers, (copy)writers, artists, translators, interpreters, etc.

- Online sellers – Buisnesses selling physical goods online on Amazon or other larger online shopping platforms (e.g. Shopify or Etsy).

- Dropshipping – Businesses where the goods you are selling are never actually “owned” by your company and where the seller (producer) handles the shipping to end-clients (incl logistcs and Vaue Added Tax).

“e-Residency + company in Estonia” solution works fine (under certain conditions)

- Holding companies – Businesses where the only activity is holding shares of other businesses. With such business type, please bear in mind that in case the size of the businesses you hold (wholly or partially) grows, your Estonian holding company may become subject to auditing and consolidating requirements. When this becomes necessary, your Estonian company will need to buy additional auditing services, which will be an additional annual cost. Your Estonian accountant cannot handle this process, as you must buy auditing services from an independent third party (such as KPMG, PWC, Deloitte, etc).

- Investment vehicles – in case of larger sums of money, you probably want to open a bank account in a commercial bank. Payment service providers may not be the best option for you. At the same time, Estonian fully online business environment and a corporate income tax system, where corporate income tax is levied only on dividends, is a considerable benefit for investment vehicles.

- Crypto currency related businesses – In case you wish to provide crypto currency wallet services or operate your own crypto currency exchange, you will need a licence. Please read the information on the website of the Estonian Financial Inspectorate and consult with them before making further plans. Please also note that only some selected service providers in Estonia offer their accounting and consulting services in the field of crypto currencies. Please consult the e-Residency Marketplace to find such service providers.

- Travel agencies – you may be subject to licencing in Estonia and may need to submit a financial deposit in Estonia as collateral.

- Event organisers in Europe – European VAT rules stipulate that you need to pay VAT in the country in which the event takes place. Accounting, reporting and paying VAT in other countries outside Estonia is usually not handled by Estonian service providers. You will need a local (or international) VAT service provider, which will add to your operating expenses.

“e-Residency + company in Estonia” might not be the best option for

- Localised businesses (outside Estonia) dealing with physical goods – Examples include a tobacco shop on a street corner, a car spare parts shop, restaurants / bars, factories, etc.

- Localised businesses (outside Estonia) offering services to local private customers – Examples include dentists, hairdressers, beauty parlours, etc.

- Trading business of physical goods (where the warehouse or distribution centre is not located in Estonia) – European VAT rules may make it unnecesarily complicated to use an Estonian company. It may be a better option to find a European distributor for your products or to set up a company in the country where your goods will physically be stored.

Your Estonian company is registered in Estonia and is taxed in Estonia. This taxation is handled and collected by the Estonian Tax and Customs Board. See their website for various information about taxation in Estonia: https://www.emta.ee/eng

e-Residents who own and manage companies in Estonia are usually themselves not Estonian tax residents, simply and mainly because they do not actually live in Estonia. It is therefore possible, that your home country (the country in which you are a tax resident), may wish to tax you additionally. This may concern corporate income tax or any other taxes. In doing so, foreign tax authorities can base their claims on the fact that your company’s actual location of doing business is in their jurisdiction (according to the principle of paying taxes in the country where the value is generated.)

It is therefore very strongly advisable, that when you set out in running your Estonian company, you pay a visit to a qualified tax advisor in your home country. Please explain to your tax advisor that you have established a company in Estonia and describe the business model that you intend to use. Ask your tax advisor to describe to you what tax obligations you may face in your home country (if any).

Please inform us about the advice you have received from your tax advisor in your home country and keep in mind that e-Residency Hub handles your taxation only in Estonia. We do not handle tax reporting in other countries and any tax reporting (and of course, paying these taxes in other countries) will have to be done by you. You can read more about taxation of e-residents’ companies on the e-residency blog: https://medium.com/e-residency-blog/how-do-e-residents-pay-taxes-73b8c96902b6

Labour Taxes

According to Estonian tax regulations and practice, in case a company generates sales revenue, the company also needs to pay salaries (i.e. if value is created, which you are selling, somebody needs to work to create that value and that work needs to be compensated by some sort of payments). Thus, in case your company sells goods or services, you are expected to pay salaries to the people who do that work. Holding companies, where value is generated simply by the increasing prices of the assets that the company passively holds, do not have to pay salaries if they do not wish to.

Employees in Estonia

In case you plan to employ people who are tax residents of Estonia, please send us their Estonian ID code and start and end dates of their employment contracts. You must do that BEFORE these people begin actual work in Estonia. We will enter this information in the Estonian Employee’s Registry.

NB! Employees who are not Estonian tax residents and do not live in Estonia do not need to registered! In case your company is paying salaries to its employees who are Estonian tax residents, the company is required to withhold the following taxes and transfer them directly to the Estonian Tax and Customs Board:

- 20% of personal income tax

- 1.6% unemployment insurance payment (employee’s share)

- 0.8% unemployment insurance payment (employer’s share)

- 33% social tax

In case the company has employees who are not Estonian tax residents and who live and work outside Estonia, salary payments to these foreign employees are not taxed in Estonia and we do not submit any tax declarations about these employees. In such case, these foreign employees must declare their income from your Estonian company in the country in which they live and are tax residents.

It is your responsibility to make sure any income of your foreign employees is properly declared in the foreign countries in which they live. In case any supporting documentation is required on behalf of your Estonian company – please let us know.

Business trips

As e-residents, you do not actually live in Estonia. When accounting for business trips, your home country rules apply (amount of per diems, what kinds of expenses can be considered business expenses, etc).

Dimitris Paraskevopoulos is a seasoned Greek entrepreneur who has been active in business since 1992. In 2019, he decided to merge his food, health and cosmetics business with his Estonian company, Gourmante Baltics OÜ, which he founded using e-Residency.

When it came time to establish his new company, Dimitris was looking for speed and simplicity, along with access to online tools which could help him efficiently manage his company from abroad.

Gourmante Baltics OÜ sells health and cosmetics products on Amazon and, using a distributor, Mediterranean food products in Estonian retail outlets. Dimitris’ products are produced outside Estonia in different parts of the world, including the US. Overall, Dimitris enjoys selling on Amazon as an e-Resident:

“In my experience, Amazon’s online business is a perfect fit with the online e-Residency environment. This is primarily because of the web-based tools offered by the programme as a whole, in addition to individual service providers such as e-Residency Hub.”

Estonia vs Greece

Comparing Estonia to Greece, Dimitris mentions that, while the process and speed of setting up a company in Greece has improved recently with the introduction of IKE (a type of Private Limited Company), accounting costs are still relatively high compared to Estonia. In Greece, most entrepreneurs pay at least €350-400 per month for accounting services. And in the case of Amazon sellers, accounting costs are significantly higher. Plus, legal and auditing fees in Greece amount to several thousand euros annually, whereas in Estonia they are typically much lower.

Banking poses further challenges. In Greece, opening multi-currency accounts is limited by local law. It is also impossible to connect a Greek bank account to an Amazon seller’s account, and exchange rates create additional costs which can often be quite significant. Finally, service fees in traditional Greek banks are widespread and very high (e.g. fees are charged for all incoming and outgoing payments, and even for simply checking an account balance). Compared to Estonian banks, which offer online services and reasonable fees, the difference is clear.

Taxation is another differentiator between Estonia and Greece. Greece imposes a 2% tax on all online advertising (no such tax exists in Estonia), and Greek tax requirements force entrepreneurs to maintain a separate receipt printer which is directly connected to the Greek tax authorities and which prints receipts the same day that sales are generated. For Amazon sellers, this requirement creates an unnecessary obstacle for smooth business operations — especially considering that online sales can be generated around the clock, including weekends and holidays.

Taking into account the above differences between Greece and Estonia, it seems clear that online access to service providers — as well as the flexibility and attention to customer’s needs that such service providers offer — make Estonia an easy choice when selecting where to incorporate your business.

Banking

Dimitris has chosen LHV as his banking partner in Estonia. In addition he is also actively using two large payment service providers — TransferWise and Payoneer. He describes his experiences as follows:

“I would particularly highlight the importance of multi-currency payment solutions for anyone selling on Amazon. If your income is generated in different currencies across various Amazon marketplaces (in our case: EUR, USD, and GBP), the ability to keep several currencies in your account and make payments from these respective currencies saves a lot of time and money while managing the company.

Payoneer is specifically designed for Amazon sellers. When your sales revenue reaches a certain level, you can start receiving advance financing, which can be important for cash flow management. TransferWise also offers strong value through competitive exchange rates. We use both of these service providers in our daily business.”

Web-based accounting platform of e-Residency Hub

According to Dimitris, using e-Residency Hub’s platform called Envoice to handle his purchase and sales invoices is very easy. It is so easy, in fact, that he has chosen to do it himself rather than asking an assistant to handle it.

Amazon sales accounting is handled by e-Residency Hub, which covers all bookkeeping and sales data. For VAT reporting outside Estonia, Dimitris uses Amazon VAT services. Dimitris’ personal e-Residency Hub accountant can extract data from his Amazon seller’s account and Amazon’s VAT service to ensure the company’s Annual Report includes all global VAT payments.

Dimitris continues:

“For transactions outside of Amazon, creating sales invoices in Envoice is very easy. Raising a new invoice only takes a few clicks, and this is especially true for existing clients. For purchase invoices, it is equally simple — I only need to forward the invoices to my custom Envoice email address, and my personal e-Residency Hub accountant handles the rest.

The mobile app is also something that I frequently use for receipts and paper documents. Even when I have to manage more documents than usual, the work required from me is never more than one hour per week. By giving my accountant viewing access to my company’s bank accounts, I save the trouble of having to send monthly bank statements to her, which reduces my workload even further.”

Working with e-Residency Hub

Dimitris describes his experience working with e-Residency Hub as follows:

“At first, I made my decision solely based on the e-Residency Hub website. Setting up my company online through e-Residency Hub was very easy and convenient. The whole process took only a few days.

Over the past years I have had the luxury of meeting the e-Residency Hub team face-to-face several times to discuss the specific needs of my business. The possibility to hold such personal meetings (either in person or via Skype) was also very important for me.

All interactions since then have been very positive and extremely pleasant. I have always received quick answers to my accounting or tax-related questions. The opportunity to meet with the team during my visits to Tallinn has provided additional value. They even helped me find my business partner for trade financing!”

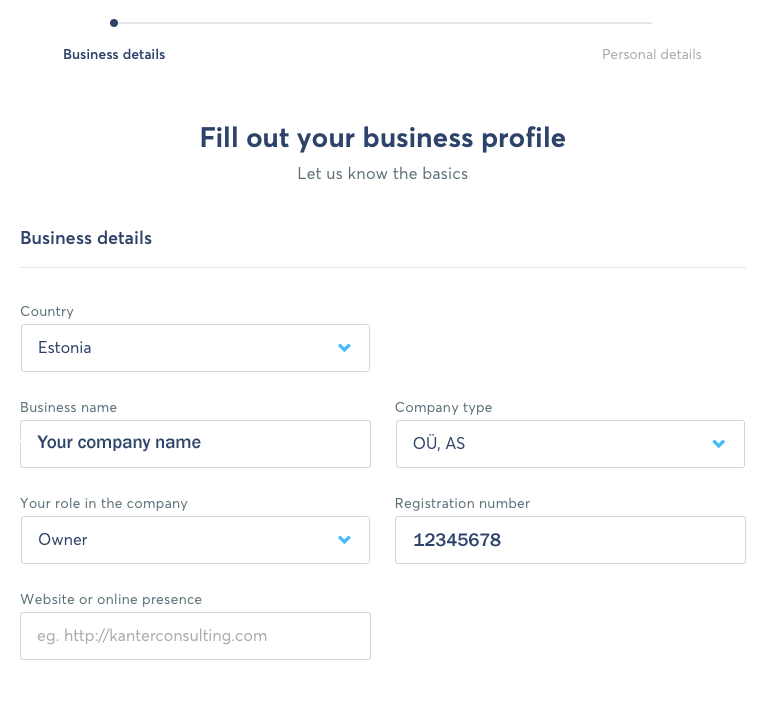

Establishing a company through e-Residency Hub is easy. The entire process can be completed in just a few days following the steps below.

Choose a name

Enter your desired company name. The company’s name must be entered using Latin characters. e-Residency Hub will automatically check against the Estonian Business Registry to ensure your selected name is available.

If your company name is similar to another name which is already registered, you will get an alert. It is then up to you whether to proceed with your selected name or choose another name. If you choose to proceed anyway, there is a chance that your selected name will be rejected by the court. In this case, you can still change the name and get your company registered without any additional costs.

Enter your company details

Enter your personal details (name and address). Note that the address where you conduct business will be publicly available on your company’s registration certificate. We will provide you with a legal mailing address in Estonia. You will be asked to enter your Estonian ID code, which is an 11-digit number printed on your e-Residency card.

Next, select your company’s business area. If your company’s business area is not listed, you may describe it in your own words and we will select the best option for you. Please note that you need to report your company’s primary field of activity to the Estonian Business Registry. If your business is complex and involves other fields, you do not need to specifically inform the Estonian Business Registry. However, if your primary field of activity changes, then you must accordingly update your entry in the Estonian Business Registry.

We also need information about other beneficial owners your company may have. “Other beneficial owners” are people who do not feature on a company’s formal registry card, but who in reality have a controlling role over the decisions the company makes. If such persons exist, you must provide their personal data as well. If such other beneficiaries do not exist, you must confirm this by ticking the appropriate box. Read more here

Describe your business

Tell us about your plans and the type of business you intend to conduct. This includes info about what you are going to sell, who are your typical clients and suppliers.

Choose your plan

Choose the pricing level that is best suited to your needs. We offer four pricing tiers to ensure a good fit for everyone. You are always free to change your plan in the future. If you need any support regarding our pricing plans, get in touch.

At this stage you can select the type of banking solution you wish to have for your new Estonian company. We currently work with a payment service provider TransferWise and a traditional commercial bank LHV. You should also read our article about selecting the best banking partner where we describe the key terms and conditions for their services.

For concrete step-by-step instructions click below

- TransferWise

- LHV

Review and pay

Review the summary page, which provides an overview of all details you have provided. If you need to change anything, you can go back and make the relevant edits. Once everything looks good, confirm your answers and pay. You can pay using credit card, bank transfer, or PayPal. As soon as payment is transferred, you will get a confirmation email and receipt.

Authenticate

After we have reviewed your application, you will need to verify your email address and digitally sign the company establishment documents using your Estonian ID card (learn how to digitally sign documents here). After digitally signing the documents, an Estonian court will make a formal decision and issue your company’s registration number. You will receive a confirmation email from the court within three business days.

Sign the contract

After your company has been formally established, you will be able to digitally sign a contract between your new Estonian company and e-Residency Hub.

E-Residency Hub acts as your company’s legal mailing address, physical mailbox, and main point of contact in Estonia. Any physical mail that is sent to your company’s Estonian address will be received by us.

Please reference the table below for details regarding our mail processing services:

Service |

Price |

| Opening letters, scanning the contents, and emailing the scanned files to you. | Free with any plan |

| Forwarding original hard copies by registered mail.

E-Residency Hub will provide you with a tracking number for every shipment. Within Europe, mail is usually delivered within 1–2 weeks; outside of Europe, mail may take 3+ weeks. Registered mail is handled by the Estonian Postal Service and the postal services of the receiving country. |

€36 per shipment |

| Forwarding original hard copies by courier.

E-Residency Hub will provide you with a tracking number for every shipment. Delivery times are typically 2–5 days. Mail sent by courier is handled by UPS. |

€108 per shipment |

The above prices apply for letters and documents. All prices are inclusive of VAT. If you receive larger parcels that must be forwarded, the shipping price will depend on the size and weight of the package.

Addressing letters to your company

All letters and shipments sent to your company must also reference e-Residency Hub on the envelope or package. Below is an example of how the address must be written:

[Company Name]

Ahtri 12

10151 Tallinn

Estonia

Attn: E-Residency Hub

**Please note that without this reference to e-Residency Hub on the address label, the letter or package may not get delivered to us.

When to use your legal address

We recommend you use your company’s legal address only when it is required by the sender. For example, banks or payment service providers often refuse to send bank cards and similar sensitive items abroad; these must be delivered to your company’s legal address. In these cases, we will gladly receive the documents on your behalf.

However, we recommend that you use your actual address (outside of Estonia) for all day-to-day business communication, product samples, customer correspondence, and so on. Receiving mail yourself will save you time and money.

Archiving

If you require, we will archive incoming mail (specified letters and documents) for up to one year after the date received. Archiving is free of charge. If you would like to archive documents for more than one year, we reserve the right to charge a fee. This fee depends on the volume of documents to be archived. Archiving and storage of large or bulky items shall be agreed and billed separately on a case-by-case basis.

For easy remote administration of your company, you will be given access to our proprietary web-based accounting platform, Envoice. Access to Envoice is part of our services to you and is included at no extra cost.

Envoice makes it easy to do the following:

- Send us your accounting documents, such as invoices and receipts.

- Create your sales invoices and send these out to your clients.

- Create travel and expense reports, which are necessary if you have business trips abroad or when your company must reimburse you for out-of-pocket expenses.

Documents sent to Envoice will be automatically routed to your personal accountant.

Creating an account

After signing the e-Residency Hub contract, you will receive an email from Envoice confirming that your account has been created. To get started, you will be asked to confirm your email address and create a password. Once your email address has been verified, you are good to go. After logging in, you will see your Dashboard, which includes the most important accounting metrics of your business.

Sales invoices

Envoice makes it easy to create sales invoices and send them directly to your customers via email. After inputting the sales values, Envoice will automatically calculate the correct taxes. You will also able to duplicate invoices from previous entires and choose your customer from a predefined list of past customers. This makes the creation of sales invoices much more efficient, as you don’t need to start from scratch every time.

Purchase invoices

After registering with Envoice, you will receive a personalised @envoice.ee email address. All purchase invoices should be sent to your personal Envoice email address, either in PDF or JPG format. Please make sure you send only one invoice at a time. Please also ensure each invoice contains the following:

- Title (e.g. “Invoice” or similar)

- Invoice number

- Date of issue

- Description of goods or services purchased

- Numerical data (amount, price of unit, total sum)

- Names of the seller and buyer

- Addresses of the seller and buyer

- Seller’s company registration number

- Seller’s VAT number (when applicable)

Please send your purchase invoices to your personal Envoice email address no later than the 5th day of the following month.

Note that you only need to send invoices and receipts which are related to your company’s business. Please do not send other documents, such as bank statements, payment confirmations, and so on.

All documents sent to Envoice will be digitised. This process is automatic and takes about six hours. Once your documents have been digitised, they will remain accessible to you under Purchases. From there, you can search and filter your invoices and receipts according to various criteria. In this way, Envoice also acts as a business archive.

Legal precautions

It is extremely important that your finances are conducted correctly according to the law. At e-Residency Hub, we will do our best to assist you in this regard, but you are still responsible for the following:

- Manually upload copies of your bank statements every month (applies only if you are not a customer at LHV Bank).

- Make sure all incoming payments have a corresponding invoice. You can create these using Envoice or upload your own.

- Make sure all outgoing payments have a corresponding expense document.

- Make sure all business expenses are proper and correct.

- Reply to all e-Residency Hub emails and requests in a timely manner.

- Review and sign documents, when requested.

Using Envoice’s Self-Service Dashboard should keep your life simple. Just follow the prompts and instructions to stay on top of your company finances.

In addition, each quarter we will prepare and send your company’s Balance Sheet and Profit & Loss statement. This way, you will have a better idea of your company’s finances.

Using the Envoice app

Envoice also has a mobile app for iOS and Android. It is available for free download. Once you have downloaded the app, you can can log in using the same username and password you use on the Envoice website.

The Envoice app allows you to easily scan paper receipts and invoices by simply taking a photo of them. Scanned receipts and invoices can then be automatically sent to your company’s accountant.

You can also use the Envoice app to generate travel and expense reports. By uploading scanned receipts in real time, you can easily track and manage travel expenses on the go. No need to face a mountain of paper receipts upon your return.

e-Residency Hub provides full accounting services for companies selling their goods on Amazon or other e-commerce platforms. The information below is based on the example of Amazon. In case you wish to sell your products using another e-commerce platform, please get in touch with us to discuss the details of our services to you.

During the process of company establishment, if you indicate that your business activities will include selling goods online, you will be asked to provide us with some extra data, which will help us to understand your business better and provide you with our services.

e-Residency Hub services to you

e-Residency Hub handles your company’s accounting. As e-commerce activities usually require you to submit VAT declarations in other countries of the European Union, we cooperate with a trusted third-party service provider to help you with pan-Europe VAT filings. Alternatively, you can order such services directly from Amazon.

Our service to you includes

- Booking your aggregated sales data, based on the VAT reports generated by our VAT partner or Amazon VAT

- Preparing and submitting your company’s Estonian tax declarations if applicable

- Preparing and submitting your company’s annual report to the Estonian Business Registry

- Collecting data from our pan-european VAT service providers and incoporating that into your company’s bookkeeping

Value Added Tax

Value Added Tax (VAT) is a topic which makes e-commerce operations in Europe different from many other types of businesses. You as an Amazon seller will need to register for VAT in the country(ies) in which your goods are being stored by Amazon. It is also necessary to keep track of your sales volumes in diferent EU Member States – once you reach a certain limit of sales in any given year, you will be required to also register for VAT in those countries as well and start paying VAT there.

As a seller on Amazon, your company does not need an Estonian VAT number. Instead, you need a VAT number in the country in which your goods are stored by Amazon. In case you choose to store your goods in several Amazon warehouses in several European countries, you need to apply for a VAT number in each of these countries. You will also need to submit monthly or quarterly VAT declarations in all the countries from which you have a VAT number.

It is important to keep in mind that each additional VAT number will create additional set-up costs and regular costs for you. These costs will occur because your VAT service provider will need to submit tax filings in each separate country and you will be required to pay VAT in each country.

Please read carefully the FAQ assembled by amazon on VAT issues

Every business needs a bank account to operate in the modern world. This is particularly true for companies managed online by e-Residents. At e-Residency Hub, we can help you through this critical step in the company formation process.

Estonian companies have access to two types of accounts:

- Accounts at conventional commercial banks.

- Accounts through online payment service providers.

Both types of accounts are available to e-Residency Hub users, but some restrictions and conditions apply.

Conventional commercial banks

E-Residency Hub’s official banking partner is LHV Bank, based in Estonia. Their policies for non-residents are described in detail here: https://www.lhv.ee/en/non-residents#business-client

In order to open an account, LHV Bank requires clients to have a “clear connection to Estonia.” This could mean that you have employees who live and work in Estonia; that you own and manage property in Estonia; that you regularly receive or make payments to Estonian residents (private persons or companies); or other such connections. If you do not have a clear connection to Estonia, but your business operates online and is entirely service-based (e.g., programmers, app developers, etc.), then the bank may nonetheless agree to open an account for you.

Note that LHV typically does not work with companies handling cryptocurrencies or companies buying or selling physical goods (unless these goods are imported into or stored within Estonia).

To apply for an LHV account, you can begin the process online. To maximise your chances of a positive outcome, we are glad to review your application before you submit it to the bank. After completing the application, it usually takes 1–2 weeks for the bank to issue a response.

If LHV approves your application, you must travel to Estonia to personally identify yourself and finalise the account opening procedures. This is the only time you will need to be physically present in Estonia. Once your account is activated, you will be able to conduct all future business transactions online.

Payment Service Providers (PSPs)

E-Residency Hub formally cooperates with Wise and Payoneer to offer online payment services for our clients. After registering with e-Residency Hub, we will send you detailed instructions about how to open a business account with one or both of these providers.

Please keep in mind that both Wise and Payoneer are independent companies who will make their own decisions regarding their provision of services. Both companies have Know Your Customer (KYC) procedures and conduct thorough vetting procedures to validate any businesses applying for an account. Therefore, we cannot guarantee that you will be able to open an account with these PSPs. In most cases, however, e-Residency Hub users have not encountered any issues.

When seeking a payment partner, you are free to approach other PSPs, such as Paysera, Monese, or Revolut. However, please keep in mind that the account you open must belong to your Estonian company (not to you as an individual).

Bank cards

Both PSPs and conventional banks can issue official banking cards. These usually take the form of MasterCard or Visa cards which can be used to make payments online, pay at points of sale, and withdraw money from ATMs. Having an account with an associated banking card is often a prerequisite for opening accounts with payment gateways, such as PayPal or Stripe.

Permanent establishment

Permanent Establishment (PE) is a concept created for tax purposes. According to the OECD, a permanent establishment is a fixed place of business through which the business of an enterprise is wholly or partly carried out. The practical meaning of a PE is that it creates a taxable presence for a company outside the company’s country of establishment. A PE can also be triggered through individuals acting on behalf of a company. PE should not be confused with a place of business, place of tax residency, or place of effective management.

As each country has a different approach to PEs, be sure to always refer to available information about PE registration and compliance in the jurisdiction where your activities might trigger a PE. Also note the following:

- A PE can only be created for a company in another country.

- A PE cannot be created in the state where the company itself is established.

- There can only be one PE per country.

- PEs must be duly registered with the local tax authorities.

- PEs are usually taxed as separate legal entities.

According to the above, an Estonian company cannot have a PE in Estonia. However, it’s possible that an Estonian company could have a PE in Germany, for example, if the company’s activities satisfy all requirements for creating a PE in Germany. Estonia exempts PE profits from Estonian corporate taxation, thereby avoiding double taxation of profits earned by business activities of a PE.

Dual residence

Most countries reserve the right to tax their residents (and their residents’ companies) on worldwide profits. Many countries have introduced broad definitions of who is considered a tax resident, and when definitions overlap, a taxpayer could be considered a tax resident in two countries. This is generally called Dual Residence.

In Estonia, the rule is simple: if a company is incorporated under Estonian laws, the company is considered a tax resident. All companies registered with the Estonian Business Register are considered tax residents and are therefore subject to taxation in Estonia.

However, in addition to being a tax resident in Estonia, some companies might have dual tax residence. For example, some countries stipulate that the place of effective management triggers tax residency. Thus, if a company was incorporated under Estonian laws but is effectively managed in another country, that company may be considered a dual resident and may have profits taxed in two countries.

Note that a company with dual residence is not the same as a company with permanent establishment in another jurisdiction. Also keep in mind that rules for determining tax residency are different for companies and individuals.

Overview of select countries

Below is a summary of how some countries understand permanent establishment and dual residency. The descriptions are based on publicly available information and are only meant as a quick reference. Always work with a local tax expert to clarify any tax consequences which may apply to your particular situation.

Ukraine

Permanent establishment

Ukraine generally follows the OECD definition of PE. Ukraine recognizes three types of PEs: Classical PE, Agent PE, and Service PE. Ukrainian tax law provides a list of common PEs, such as place of management, affiliate, office, server, and so on. The presence of an international tax treaty should override Ukrainian domestic rules if the treaty is more beneficial to the taxpayer. Please refer to the State Fiscal Service of Ukraine for more information.

Tax residency

In Ukraine, a company is considered a tax resident if it is established under Ukrainian law. Managing an Estonian company in Ukraine should not lead to dual residency. For more information, visit the State Fiscal Service of Ukraine: http://sfs.gov.ua/en/

Germany

Permanent establishment

According to German rules, a PE is any fixed business facility serving a corporate purpose. A permanent representative is someone who “habitually” deals on behalf of the principal (the principal being the Estonian company, for example) and acts according to the principal’s instructions. German tax treaties are usually in line with the OECD’s definition.

Tax residency

In Germany, a company is considered a tax resident if either its place of incorporation or its main place of management is in Germany. If you effectively manage your Estonian company in Germany, then the company may be considered a dual resident. In this case, the Estonia-Germany tax treaty or competent authorities should be consulted.

For more information, please refer to the German Ministry of Finance: https://www.bundesfinanzministerium.de/Web/DE/Home/home.html

United Kingdom

Permanent establishment

In the UK, a PE is created if the non-resident company:

- has a fixed place of business in the United Kingdom through which the business of the company is wholly or partly carried out; or

- has an agent acting on behalf of the company has and habitually exercises authority to do business on behalf of the company in the United Kingdom.

Tax residency

Companies incorporated abroad may be considered UK residents if the place of central management and control is situated in the UK. In this case, the company may be considered a dual resident. Please consult the Estonia-UK tax treaty or competent authorities. And for more information, visit HM Revenue & Customs: https://www.gov.uk/government/organisations/hm-revenue-customs.

Spain

Permanent establishment

Under Spanish law, a PE is created if a company has ongoing or habitual work facilities in Spain. An agent PE is created if a company acts through an agent who has powers to behave on behalf of the non-resident, and if such powers are exercised on a regular basis.

Tax residency

In Spain, a company is considered a tax resident if it was founded in Spain, or if its business activities are managed and controlled from Spain. In this case, the company may be considered a dual resident. Be sure to consult the Estonia-Spain tax treaty and competent authorities on this matter. And for more information, visit the Spanish Tax Agency: https://www.agenciatributaria.es/

France

Permanent establishment

In France, a PE is created through:

- business activity conducted through an establishment (e.g. a branch, sales office);

- business conducted in France by a dependent agent; or

- the existence of a complete commercial cycle in France.

If there is any doubt, French tax authorities will rule on the existence or nonexistence of a PE.

Tax residency

Generally, only companies established under French law are considered French tax residents. Therefore, there should be no issue with dual residency pertaining to Estonian companies, even if the Estonian company is effectively managed in France. For more information, visit the Ministry of Action and Public Accounts: https://www.impots.gouv.fr/portail/

Turkey

Permanent establishment

Under Turkish law, the threshold for the creation of a PE is lower than that described by the OECD. Whether your activities create a PE in Turkey must be evaluated on a case-by-case basis. It is recommended to consult with the relevant tax authorities.

Tax residency

In Turkey, a company is considered a tax resident if the business’s headquarters are in Turkey. Therefore, if an Estonian company is headquarted in Turkey, the company may have dual residence. Be sure to consult the Estonia-Spain tax treaty and competent authorities on this matter. For more information, visit the Turkish Revenue Administration: https://www.gib.gov.tr/en