Articles

Setting up business banking04. February 2020

Every business needs a bank account to operate in the modern world. This is particularly true for companies managed online by e-Residents. At e-Residency Hub, we can help you through this critical step in the company formation process.

Estonian companies have access to two types of accounts:

- Accounts at conventional commercial banks.

- Accounts through online payment service providers.

Both types of accounts are available to e-Residency Hub users, but some restrictions and conditions apply.

Conventional commercial banks

E-Residency Hub’s official banking partner is LHV Bank, based in Estonia. Their policies for non-residents are described in detail here: https://www.lhv.ee/en/non-residents#business-client

In order to open an account, LHV Bank requires clients to have a “clear connection to Estonia.” This could mean that you have employees who live and work in Estonia; that you own and manage property in Estonia; that you regularly receive or make payments to Estonian residents (private persons or companies); or other such connections. If you do not have a clear connection to Estonia, but your business operates online and is entirely service-based (e.g., programmers, app developers, etc.), then the bank may nonetheless agree to open an account for you.

Note that LHV typically does not work with companies handling cryptocurrencies or companies buying or selling physical goods (unless these goods are imported into or stored within Estonia).

To apply for an LHV account, you can begin the process online. To maximise your chances of a positive outcome, we are glad to review your application before you submit it to the bank. After completing the application, it usually takes 1–2 weeks for the bank to issue a response.

If LHV approves your application, you must travel to Estonia to personally identify yourself and finalise the account opening procedures. This is the only time you will need to be physically present in Estonia. Once your account is activated, you will be able to conduct all future business transactions online.

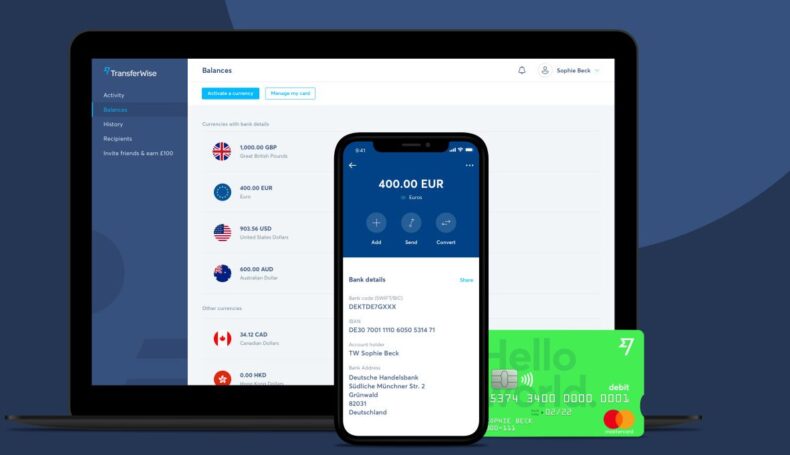

Payment Service Providers (PSPs)

E-Residency Hub formally cooperates with Wise and Payoneer to offer online payment services for our clients. After registering with e-Residency Hub, we will send you detailed instructions about how to open a business account with one or both of these providers.

Please keep in mind that both Wise and Payoneer are independent companies who will make their own decisions regarding their provision of services. Both companies have Know Your Customer (KYC) procedures and conduct thorough vetting procedures to validate any businesses applying for an account. Therefore, we cannot guarantee that you will be able to open an account with these PSPs. In most cases, however, e-Residency Hub users have not encountered any issues.

When seeking a payment partner, you are free to approach other PSPs, such as Paysera, Monese, or Revolut. However, please keep in mind that the account you open must belong to your Estonian company (not to you as an individual).

Bank cards

Both PSPs and conventional banks can issue official banking cards. These usually take the form of MasterCard or Visa cards which can be used to make payments online, pay at points of sale, and withdraw money from ATMs. Having an account with an associated banking card is often a prerequisite for opening accounts with payment gateways, such as PayPal or Stripe.